TCFD Reporting Services

Task Force on Climate-related Financial Disclosure

The Task Force on Climate-related Financial Disclosure (TCFD) is an organisation whose aim is to develop voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers and other stakeholders. There is rapid uptake of the TCFD reporting recommendations and significant investor interest. Organisations will need to respond to the reporting recommendations and IMS Consulting (Europe) Ltd are well placed to assist.

Why it is important to respond to the TCFD recommendations now?

The UK’s Green Finance Strategy sets out the Government’s expectations for all listed companies to disclose in line with the TCFD recommendations by 2022

CDP has already amended its disclosures to include a section related to the risks and opportunities arising from climate change, which is based on the TCFD recommendations

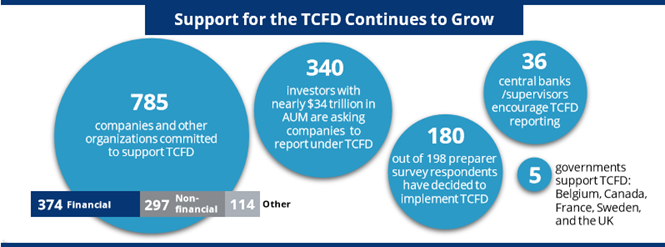

According to a 2019 TCFD status report, 340 investors with nearly $34 trillion in assets under management are asking companies to report under the recommendations

Source: TCFD 2019 Status Report

TCFD Recommended Reporting

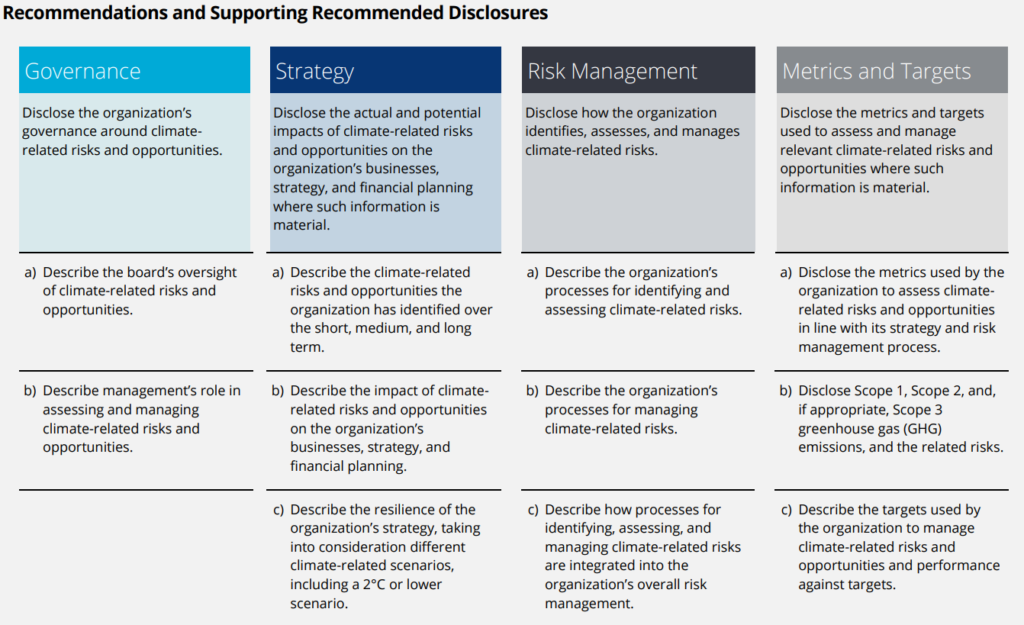

There are eleven recommended reporting areas within the TCFD recommendations (outlined below).

Source: TCFD 2019 Status Report

Whilst TCFD accepts a graduated approach to reporting, an area where many organisations struggle is in considering climate-related risks and opportunities and describing the resilience of the organisation taking into account different climate-related scenarios.

TCFD Risks and Opportunities

Once you have effective Governance in place to address climate-related risks and opportunities and to report specifically against the TCFD reporting recommendations, the next step that many organisations will take is to assess climate-related risks and opportunities and to consider whether these could be material to the business. Key questions to ask include:

– What are the current and anticipated organisational exposures to climate-related risks and opportunities?

– Do these have the potential to be material in the future?

– Are organisational stakeholders concerned?

Risks and opportunities can broadly be divided between physical risks such as increased wildfires, tropical storms or chronic changes in temperature and sea level, and transitional risks. Transitional risks arise from potential changes in policy and legislation, technology or market preference.

The risks will be specific to your organisation but could include consideration of different carbon prices or the impact of more extreme weather patterns on your business operations.

Considering your organisation’s climate related risks and opportunities can also come in useful for your CDP disclosures. Sub-standard reporting within the risks and opportunities section of CDP climate is an area where many of CDP’s reporting points are lost. Strengthening disclosures here can have a significant influence over whether you will or will not receive a leadership score for CDP climate and is an area where IMS can also help.

Once you have selected a range of risks and opportunities, TCFD recommends considering these against a range of scenarios (i.e. different climate states). The next section delves deeper into TCFD scenario analysis.

TCFD Scenario Analysis

The TCFD suggests that organisations report on the resilience of their strategies, taking into consideration different climate-related scenarios, including a 2 degree or lower scenario. A 2 degree or lower scenario is one which limits the global average surface temperatures from rising to 2 degrees above pre-industrial levels. This scenario is expected to avert the worst consequences of climate change and is one which 195 signatories agreed to work towards as part of the 2015 Paris Agreement. Under a 2 degree or lower scenario it is broadly accepted that there will be significant changes to policy and legislation to mitigate expected climate impacts on the environment (i.e. significant transitional risks).

An alternative scenario, and one which is being considered by a number of organisations, is a “business as usual” scenario. This is where no mitigating actions are taken to slow or prevent climate change and the world warms considerably (more than 3 degrees). This scenario is generally accepted to give rise to dramatic climatic, biodiversity and sea level changes (i.e. physical risks).

TCFD reporting – How can IMS assist with the TCFD reporting process?

Looking at climate-related risks and opportunities and translating these into financial metrics is a key area of interest for Helen Wain – IMS’ lead TCFD consultant. She bridges the gap between sustainability and finance, providing high quality services to clients with regard to strengthening their climate-related disclosures. With her financial background she is well suited to understanding how to analyse different parts of the business using information that is easily available, and translating this into useful, investor friendly disclosures that convey appropriate understanding of the TCFD reporting recommendations.

Introducing Helen Wain ACA, CTA

TCFD Lead Consultant

Check out my LinkedIn profile:

http://bit.ly/HelenWainonLinkedIn

Helen is a qualified chartered accountant, chartered tax advisor and a member of the ICAEW and CIOT. Her career includes working as corporate tax consultant for Deloitte and BDO where she also championed sustainability initiatives. Helen is currently studying for an MSc in Sustainability and Environmental Management and joined IMS to expand the services provided to clients and investors, particularly relating to the new TCFD reporting framework.

Next steps for your TCFD reporting journey

The disclosures look set to become mandatory in the near-term, and early adoption of the legislation would be beneficial as it can be challenging to implement. Responding to the recommendations will also aide in managing climate-related risks and opportunities thus enhancing perceived value to investors and strengthening strategic resilience in adapting to a changing future.

If you are interested in finding out more about TCFD please see the publications produced by IMS using the link below. Alternatively, if you would like to speak to Helen to discover how IMS can help you to respond to the recommendations, please do not hesitate to get in touch at